Basic Details

| Elite Payplus | |

| siachen.com/elitepayplus | |

| Limited Liability Partnership | |

| 2 Employees | |

| US | |

| CA | |

| San Francisco |

Communication

| 1111, Polk Street, San Francisco, United States. | |

| 4158852258 | |

About Business

Business Summary

Now, get personal investment tips only at elite play plus blog. It will provide you

Business Description

Now, get personal investment tips only at elite play plus blog. It will provide you numerous of advice on sensible money management. For more details visit our website now. Now, get personal investment tips only at elite play plus blog. It will provide you numerous of advice on sensible money management. For more details visit our website now.Now, get personal investment tips only at elite play plus blog.

Detailed Business Description

Elite Payplus: Pioneering Financial Solutions for the Modern World

Introduction

Welcome to Elite Payplus, headquartered at 1111, Polk Street. We are a leading force in the financial services sector, committed to revolutionizing the way individuals and businesses manage their finances. Our journey began with a vision to create a seamless, user-friendly platform that offers comprehensive financial solutions. Over the years, we have transformed into a trusted name, known for our dedication to innovation, reliability, and customer-centric approach. Our mission is to empower our clients with the tools and knowledge they need to achieve financial success and security.

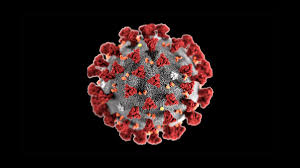

About the Financial Services Sector

The financial services sector is a dynamic and essential part of the global economy. It encompasses a wide range of services, including banking, investments, insurance, and financial planning. This sector serves individuals, businesses, and governments by providing the necessary tools and resources to manage money effectively. The importance of the financial services sector cannot be overstated; it is the backbone of economic stability and growth. Recent trends in this sector include the rise of fintech, increased focus on cybersecurity, and the integration of artificial intelligence to enhance service delivery. The future looks promising, with continuous advancements in technology poised to further streamline financial processes and improve customer experiences.

Primary List of Products and Services

At Elite Payplus, we offer a diverse range of products and services designed to meet the varied financial needs of our clients. Our primary offerings include:

- Personal Financial Planning

- Investment Management

- Retirement Planning

- Insurance Solutions

- Tax Advisory Services

- Corporate Financial Services

- Wealth Management

- Estate Planning

Each of these services is tailored to provide maximum value and support, ensuring our clients can make informed decisions and achieve their financial goals.

Company History & Founding

Elite Payplus was founded with a singular goal: to simplify and enhance the financial lives of our clients. Our journey began in the heart of the financial district at 1111, Polk Street. From our humble beginnings, we have grown exponentially, thanks to our unwavering commitment to excellence and our innovative approach. Key milestones in our history include the launch of our state-of-the-art investment platform, the introduction of our comprehensive financial planning services, and numerous awards recognizing our contributions to the financial sector. Today, we stand proud as a leader in financial services, continually striving to set new benchmarks in the industry.

Unique Value Proposition

What sets Elite Payplus apart from our competitors is our unique value proposition. We prioritize our clients' needs and place them at the center of everything we do. Our approach combines cutting-edge technology with personalized service, ensuring that each client receives tailored solutions that align with their specific financial goals. We are not just a service provider; we are a trusted partner in our clients' financial journeys. Our commitment to transparency, ethical practices, and continuous innovation ensures that we deliver unparalleled value and consistently exceed expectations.

Trustworthiness

Trust is the cornerstone of our business. At Elite Payplus, we have earned a reputation as a reliable and trustworthy partner through our dedication to transparency, ethics, and dependability. We adhere to the highest standards of integrity in all our dealings, ensuring that our clients can have complete confidence in our services. Our transparent processes, clear communication, and unwavering commitment to ethical practices have helped us build long-lasting relationships with our clients. We believe that trust is earned through consistent and honest actions, and we strive to uphold this principle in every aspect of our business.

Management Team

Our management team is comprised of seasoned professionals with extensive experience in the financial services sector. Their diverse backgrounds and expertise enable us to deliver top-notch services and innovative solutions. While we respect the privacy of our team members, we can assure you that each individual brings a wealth of knowledge and a passion for excellence to the table. Their leadership, vision, and commitment to our mission drive the success of Elite Payplus, guiding us toward new heights and ensuring that we remain at the forefront of the industry.

Unique Services We Offer

At Elite Payplus, we pride ourselves on offering unique services that set us apart from other financial service providers. Our personalized financial planning services are designed to cater to the individual needs of each client, providing customized strategies for wealth management, investment, and retirement planning. Our investment management platform leverages advanced algorithms and data analytics to provide intelligent investment recommendations. Additionally, our blog offers valuable personal investment tips and advice on sensible money management, helping our clients make informed financial decisions. These unique offerings reflect our commitment to delivering exceptional value and support to our clients.

Foundations of Our Business Success

The success of Elite Payplus is built on a foundation of exceptional customer service. We go above and beyond to ensure that our clients' needs are met and their expectations are exceeded. Our team is dedicated to providing prompt, professional, and personalized service, addressing each client's unique financial goals and concerns. We believe that building strong, lasting relationships with our clients is key to our success. By listening to their needs, offering expert advice, and delivering tailored solutions, we create a positive and impactful experience for each client. This commitment to excellence in customer service is what sets us apart and drives our continued growth and success.

Our Innovation Strategy and Future Plans

Innovation is at the heart of Elite Payplus. Our forward-thinking approach ensures that we remain at the cutting edge of the financial services sector. We continuously invest in technology and research to enhance our offerings and improve our clients' experiences. Our future plans include expanding our service portfolio, integrating more advanced technologies such as artificial intelligence and blockchain, and exploring new markets. We are committed to staying ahead of industry trends and delivering innovative solutions that meet the evolving needs of our clients. Our vision for the future is to continue leading the way in financial services, providing unparalleled value and support to our clients.

Conclusion

In conclusion, Elite Payplus stands out as a superior choice for financial services due to our commitment to innovation, personalized service, and ethical practices. Our comprehensive range of products and services, combined with our unique value proposition, exceptional customer service, and forward-thinking approach, ensures that we deliver unparalleled value to our clients. We invite you to explore our offerings and experience the Elite Payplus difference for yourself. For more details and personal investment tips, visit our blog and website. Choose Elite Payplus for a trusted partner in your financial journey.

Products / Services

Comprehensive Product and Service Portfolio of Elite Payplus

Located at 1111 Polk Street, Elite Payplus is a premier provider of an array of financial solutions designed to cater to both individual and business needs. Our suite of services and products is meticulously crafted to ensure the highest level of customer satisfaction and operational efficiency. This exhaustive guide delves into the various products and services offered by Elite Payplus, offering a detailed overview of how each can benefit you or your organization.

Payment Processing Services

Elite Payplus excels in offering state-of-the-art payment processing services that ensure smooth, secure, and efficient financial transactions. Here’s a deep dive into what we offer:

Credit Card Processing

Our credit card processing services are designed to handle transactions swiftly and securely. We support all major credit cards, including Visa, MasterCard, American Express, and Discover, ensuring that your customers have multiple payment options.

Mobile Payment Solutions

With the increasing trend towards mobile payments, Elite Payplus provides robust mobile payment solutions that enable businesses to accept payments via smartphones and tablets. Our mobile solutions are compatible with both Android and iOS platforms.

Online Payment Gateways

Our online payment gateways are designed to facilitate e-commerce transactions, providing a seamless and secure checkout experience for your customers. We offer integration with various shopping cart systems and e-commerce platforms.

Business Financial Services

Elite Payplus offers a range of financial services aimed at helping businesses manage their finances more effectively. These services include:

Merchant Cash Advances

We provide merchant cash advances to help businesses manage their cash flow. This service allows you to borrow against future credit card sales, providing you with immediate capital to invest in your business.

Payroll Services

Our payroll services are designed to streamline your payroll process, ensuring that your employees are paid accurately and on time. We handle all aspects of payroll management, including tax calculations and filings.

Invoicing Solutions

Elite Payplus offers advanced invoicing solutions that enable businesses to create, send, and manage invoices efficiently. Our invoicing system is integrated with our payment processing services, allowing for seamless payment collection.

Fraud Prevention and Security Services

Security is paramount at Elite Payplus, and we offer comprehensive fraud prevention and security services to protect your business and customer data. Our services include:

PCI Compliance

We help businesses achieve and maintain PCI compliance, ensuring that all payment card data is handled securely. Our PCI compliance services include regular security assessments and guidance on best practices.

Fraud Detection Tools

Our fraud detection tools are designed to identify and prevent fraudulent transactions. We use advanced algorithms and machine learning techniques to detect suspicious activity and mitigate potential risks.

Customer Support and Consulting Services

At Elite Payplus, we believe in providing exceptional customer support and consulting services to help our clients navigate the complexities of financial management. Our offerings include:

24/7 Customer Support

Our dedicated customer support team is available 24/7 to assist you with any queries or issues you may encounter. We provide support via phone, email, and live chat to ensure that you receive the help you need promptly.

Financial Consulting

We offer financial consulting services to help businesses optimize their financial strategies. Our team of experts provides personalized advice on a range of topics, including cash flow management, investment strategies, and financial planning.

Technology Solutions

Elite Payplus is committed to leveraging the latest technology to provide our clients with innovative solutions that enhance their financial operations. Our technology offerings include:

Point of Sale (POS) Systems

We offer advanced POS systems that are designed to streamline your sales process. Our POS systems are equipped with features such as inventory management, customer relationship management, and sales analytics.

Custom Software Development

Our custom software development services are tailored to meet the unique needs of your business. We work closely with our clients to develop software solutions that enhance their operational efficiency and support their business goals.

API Integration

We provide API integration services to help businesses connect their existing systems with our payment processing and financial management solutions. Our API integration services ensure seamless data flow and enhance the functionality of your systems.

Educational Resources

Elite Payplus believes in empowering our clients with knowledge. We provide a range of educational resources to help businesses stay informed about the latest trends and best practices in financial management. Our educational offerings include:

Webinars and Workshops

We host regular webinars and workshops on various topics related to payment processing, financial management, and fraud prevention. These sessions are led by industry experts and provide valuable insights and practical tips.

Resource Library

Our resource library is a comprehensive collection of articles, guides, and whitepapers that cover a wide range of financial topics. The library is available to all our clients and is regularly updated with new content.

Training Programs

We offer training programs to help businesses and their employees stay up-to-date with the latest tools and techniques in financial management. Our training programs are available both online and in-person, providing flexibility and convenience.

In conclusion, Elite Payplus is dedicated to providing top-notch financial solutions that cater to the diverse needs of our clients. Our commitment to excellence, innovation, and customer satisfaction sets us apart as a leader in the financial services industry.

Platform Enhanced Sections and Articles

Article by Siachen Editors to aid the customer in decision making

Evaluating a Vendor Providing Personal Investment Tips: A Comprehensive Guide

Introduction

In today's fast-paced financial world, making informed investment decisions is crucial for achieving long-term financial goals. With a plethora of investment advice platforms available, selecting the right vendor to guide you in your investment journey becomes paramount. "Elite Play Plus" is one such platform that claims to offer personal investment tips and sensible money management advice. This guide aims to provide a comprehensive evaluation framework for customers considering "Elite Play Plus" as their investment advice provider. By examining key aspects such as website credibility, content quality, user experience, customer testimonials, and more, this guide will aid in making an informed decision about the potential value of "Elite Play Plus."

1. Company Credibility and Reputation

One of the first aspects to consider when evaluating "Elite Play Plus" is the company's overall credibility and reputation within the financial industry. This can be assessed by researching the company's background, history, and any affiliations with recognized financial institutions. Additionally, checking for any certifications or accreditations that the company may hold can provide insights into its reliability. A vendor with a strong reputation and credible standing in the industry is more likely to offer valuable and trustworthy investment advice.

2. Quality of Content and Advice

The core offering of "Elite Play Plus" is its personal investment tips and money management advice. It is crucial to evaluate the quality of the content provided on their blog. This involves assessing the depth and accuracy of the advice, the qualifications and expertise of the authors, and the relevance of the topics covered. High-quality content that is well-researched, up-to-date, and tailored to individual investor needs is indicative of a reliable investment advice platform.

3. User Experience and Website Navigation

The usability and navigation of the "Elite Play Plus" website are important factors to consider. A user-friendly website with intuitive navigation ensures that users can easily access the information they need. This includes evaluating the website's design, load times, mobile compatibility, and the ease of finding specific content or advice. A positive user experience enhances the overall value of the platform and encourages users to engage with the content regularly.

4. Customer Testimonials and Reviews

Customer testimonials and reviews provide valuable insights into the experiences of other users with "Elite Play Plus." Reading through these reviews can help potential customers gauge the effectiveness and reliability of the investment advice provided. Look for patterns in feedback, such as common praises or complaints, to get a well-rounded understanding of the platform's strengths and weaknesses. Positive testimonials from satisfied customers can be a strong indicator of the platform's value.

5. Range of Topics Covered

A comprehensive investment advice platform should cover a wide range of topics to cater to different investor needs and interests. Evaluate the variety of subjects addressed on the "Elite Play Plus" blog, such as stock market analysis, retirement planning, tax-efficient investing, risk management, and more. A diverse range of topics ensures that users can find relevant advice for various aspects of their financial planning journey.

6. Frequency and Consistency of Updates

The frequency and consistency of content updates on the "Elite Play Plus" blog are crucial indicators of the platform's commitment to providing timely and relevant advice. Regularly updated content reflects an active and engaged team that is dedicated to staying on top of market trends and developments. Consistent updates also ensure that users have access to the latest information, which is essential for making informed investment decisions.

7. Support and Customer Service

Effective customer support and service are vital components of any advice platform. Assess the availability and responsiveness of the "Elite Play Plus" customer support team. This includes evaluating the various channels through which support can be accessed (e.g., email, live chat, phone) and the quality of assistance provided. A responsive and helpful support team can significantly enhance the user experience and provide reassurance in times of need.

8. Pricing and Value for Money

Finally, consider the pricing structure of the "Elite Play Plus" platform and evaluate whether it offers good value for money. Compare the cost of accessing the investment advice against the quality and comprehensiveness of the content provided. Look for any subscription plans, free trials, or money-back guarantees that can help in assessing the platform's value. An investment advice platform that offers high-quality content at a reasonable price is likely to be a worthwhile investment.

Conclusion

Choosing the right investment advice platform is a critical decision that can significantly impact one's financial journey. By thoroughly evaluating key aspects such as company credibility, content quality, user experience, customer testimonials, topic range, update frequency, customer support, and pricing, potential users can make an informed decision about the value of "Elite Play Plus." A well-rounded assessment ensures that users select a reliable and effective platform that meets their investment needs and helps them achieve their financial goals.

Article on latest trends and developments in this type of business

Latest Trends and Developments in the Personal Investment Industry

Introduction

The personal investment industry has undergone significant transformations over the past decade. From the advent of fintech innovations to the increasing focus on sustainable and ethical investment options, the landscape of personal finance is evolving rapidly. This article delves into the latest trends and developments shaping the industry, providing insights for both novice and seasoned investors.

1. The Rise of Fintech in Personal Investment

1.1 Digital Platforms and Robo-Advisors

Digital platforms and robo-advisors have democratized access to investment opportunities. These automated services use algorithms to provide personalized investment advice and portfolio management, often at a fraction of the cost of traditional financial advisors.

1.2 Mobile Investment Apps

Mobile investment apps have made it easier for individuals to manage their portfolios on the go. With features like real-time market updates, trading capabilities, and educational resources, these apps cater to both beginners and experienced investors.

2. Sustainable and Ethical Investing

2.1 Environmental, Social, and Governance (ESG) Criteria

ESG investing has gained traction as more investors seek to align their portfolios with their values. Companies are increasingly being evaluated based on their environmental impact, social responsibility, and governance practices.

2.2 Impact Investing

Impact investing goes a step further by targeting investments that generate measurable social or environmental benefits alongside financial returns. This trend reflects a growing desire among investors to make a positive impact through their financial decisions.

3. The Role of Artificial Intelligence and Big Data

3.1 Predictive Analytics

Artificial intelligence and big data are transforming investment strategies through predictive analytics. These technologies analyze vast amounts of data to identify patterns and trends, helping investors make more informed decisions.

3.2 Risk Management

AI-driven tools are also enhancing risk management by providing real-time risk assessments and identifying potential market disruptions. This proactive approach helps investors mitigate risks and protect their investments.

4. Cryptocurrency and Blockchain Technology

4.1 The Emergence of Digital Assets

Cryptocurrencies have emerged as a new asset class, appealing to investors seeking diversification. Despite their volatility, digital assets like Bitcoin and Ethereum have shown significant growth, attracting both individual and institutional investors.

4.2 Blockchain's Impact

Blockchain technology, the underlying framework of cryptocurrencies, is revolutionizing various aspects of finance, including transaction transparency, security, and efficiency. Its applications extend beyond digital currencies to areas like smart contracts and decentralized finance (DeFi).

5. Personalized Financial Planning

5.1 Customized Investment Strategies

Personalized financial planning is becoming more prevalent as investors seek tailored advice that considers their unique financial goals, risk tolerance, and life stages. Advisors are leveraging technology to offer customized investment strategies that align with individual needs.

5.2 Holistic Wealth Management

Holistic wealth management takes a comprehensive approach to financial planning, encompassing not just investments but also estate planning, tax strategies, and retirement planning. This integrated approach helps investors achieve long-term financial stability and growth.

Conclusion

The personal investment industry is experiencing a dynamic shift driven by technology, sustainability, and personalization. As fintech innovations continue to reshape the landscape, investors have more tools and resources at their disposal than ever before. Sustainable and ethical investing is becoming mainstream, reflecting a broader societal shift towards responsible financial practices. The integration of AI and big data is enhancing decision-making and risk management, while the rise of digital assets and blockchain technology is opening new avenues for investment. Personalized financial planning is empowering investors to achieve their unique financial goals with tailored strategies. As these trends and developments unfold, the personal investment industry is poised for continued growth and innovation.

A List of Five Leading and Popular Peer Companies in the Sector

Top 5 Reputable Investment Advisory Firms in San Francisco, USA

In this article, we explore five reputable investment advisory firms in San Francisco, USA. These firms offer expert advice on personal investment and sensible money management, similar to Elite Payplus. By exploring these companies, you can find reliable alternatives to manage your investments wisely and achieve your financial goals.

1. Fisher Investments - San Francisco, USA

Fisher Investments, established in 1979, is a global money management firm headquartered in San Francisco. With over 3,500 employees, the firm manages billions in assets for clients worldwide. Fisher Investments specializes in providing personalized portfolio management, annuity conversion, and financial planning services. Their team of experienced professionals offers tailored investment strategies to help clients maximize their returns and meet their financial objectives. The firm's commitment to transparency and client education sets it apart in the industry.

Visit Fisher Investments2. Dodge & Cox - San Francisco, USA

Dodge & Cox, founded in 1930, is an independent investment management firm based in San Francisco. With a team of over 250 employees, the firm manages mutual funds, institutional accounts, and individual portfolios. Dodge & Cox is renowned for its disciplined, value-oriented approach to investing. The firm focuses on long-term investments, rigorous research, and a deep understanding of the companies in which they invest. Their client-centric philosophy and commitment to excellence make them a trusted name in the investment industry.

Visit Dodge & Cox3. Charles Schwab Investment Management - San Francisco, USA

Charles Schwab Investment Management, a subsidiary of The Charles Schwab Corporation, was established in 1989. Located in San Francisco, the firm employs over 2,000 professionals. They offer a wide range of investment products, including mutual funds, ETFs, and managed accounts. Charles Schwab Investment Management is dedicated to providing low-cost, high-quality investment solutions to individual and institutional investors. Their innovative approach and commitment to customer service have earned them a strong reputation in the financial industry.

Visit Charles Schwab Investment Management4. Wells Fargo Advisors - San Francisco, USA

Wells Fargo Advisors, a division of Wells Fargo & Company, was founded in 1852. With a presence in San Francisco, the firm has a team of over 13,000 financial advisors. Wells Fargo Advisors offers comprehensive investment advisory services, including retirement planning, estate planning, and wealth management. They provide personalized financial advice tailored to each client's unique needs and goals. The firm's extensive experience and resources enable them to deliver exceptional service and results to their clients.

Visit Wells Fargo Advisors5. Franklin Templeton Investments - San Francisco, USA

Franklin Templeton Investments, founded in 1947, is a global investment management firm headquartered in San Francisco. The firm employs over 9,000 professionals worldwide and manages a diverse range of investment products, including mutual funds, ETFs, and institutional accounts. Franklin Templeton is known for its disciplined investment approach, extensive research capabilities, and commitment to client success. Their comprehensive range of investment solutions caters to the needs of individual and institutional investors alike.

Visit Franklin Templeton InvestmentsLast five profiles from the category:

-

Logo Experts – A dynamic creative agency specializing in custom logo design, web development, and digital marketing services to enhance brand identities worldwide – London, UK.

siachen.com/logoexperts

8 London Bridge St, Southwark, London, SE1 9SE, United Kingdom. land_line : +442046149582 -

Custom Packaging Pro – Your ultimate solution for top-class packaging and printing services, offering premium quality at competitive prices – Houston, Texas, United States.

siachen.com/custompackagingpro

10685-B Hazelhurst Dr. #20696, Houston, TX 77043 United States. land_line : 2813938119 -

Battery Agency – Leading sports advertising agency specializing in game, esports, alcohol, and marijuana marketing with global clientele – Hollywood, California, USA.

siachen.com/batteryag04

6515 West Sunset Blvd, Hollywood, CA, 90028, United States. land_line : +3234677267 -

SEO Solve Up – Elevating your brand’s online presence with strategic backlinks and guest posts, ensuring top search visibility – Tandlianwala, Pakistan.

siachen.com/seosolveup

Street#4, near Faizn-e-Attar, Makha Town, Tāndliānwāla, Faisalabad, Pakistan. land_line : 03213012567 -

Juvaid Bin Ahammad Digital Marketing Solutions – Expert digital marketing strategist providing tailored SEO, social media marketing, and Google Ads services for business growth – Kozhikode, Kerala, India.

siachen.com/juwaid

Kozhikode, Kerala, India. land_line : +919207042170