Basic Details

| Associates Insurance Agency | |

| siachen.com/associatesinsuranceagency | |

| Private Limited | |

| 2000 | |

| US | |

| FL | |

| Temple Terrace |

Communication

| 11470 N. 53rd St. Temple Terrace, FL 33617 | |

| +18139881234 | |

About Business

Business Summary

Associates Insurance Agency is privately owned and operated, full-service insurance agency that has provided premium insurance services Tampa.

Business Description

Associates Insurance Agency is a privately owned and operated, full-service insurance agency that has provided premium insurance services to the Tampa area and throughout the entire state of Florida for more than three decades. We offer a complete range of insurance services including personal, commercial, business, auto, bonding, risk management and more.

Associates Insurance Agency is a privately owned and operated, independent insurance agency that has provided insurance services to the Tampa area and throughout the entire state of Florida for more than three decades.

While we harness the power of the newest technologies, we believe in taking an old-school approach to customer interaction. Founded by Mike Rogers in 1991, Associates Insurance Agency was built on the belief that lasting customer relationships are based on integrity and created through the provision of honest and uncompromising service. To this day, we hold this founding principle close to our hearts and allow it to govern our every action.

We are proud to have earned the loyalty of our clients, many who have been with us since the inception of their business, and who think of us not as a third-party service provider, but rather as a trusted partner that always acts in their best interest. The relationships we have built with our clients have resulted in a thriving referral business, which we value deeply.

Detailed Business Description

Associates Insurance Agency Business Profile

1. Introduction

Welcome to Associates Insurance Agency, a full-service insurance agency based in Temple Terrace, FL. With over three decades of experience, we have been providing premium insurance services to clients in Tampa and throughout Florida. Our mission is to offer a complete range of insurance services, including personal, commercial, business, auto, bonding, and risk management, while building lasting relationships with our clients based on integrity and uncompromising service.

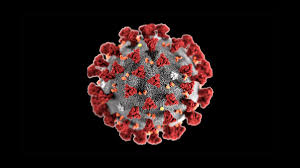

2. About Business Sector

The insurance sector is crucial in providing financial protection to individuals and businesses against unforeseen risks. Associates Insurance Agency serves a diverse range of clients, offering tailored insurance solutions to meet their specific needs. With the evolving landscape of risks and regulations, staying informed about the latest trends in the insurance sector is essential for providing comprehensive coverage to our clients.

3. Primary Products and Services

Our primary products and services include personal insurance coverage such as home, auto, and life insurance, as well as commercial insurance for businesses, risk management solutions, bonding services, and more. We strive to offer customized insurance packages that address the unique needs of each client.

4. Company History & Founding

Associates Insurance Agency was founded in 1991 by Mike Rogers with a vision to provide honest and uncompromising service to clients. Over the years, we have grown and expanded our services, reaching more clients across Florida. Our journey to becoming a trusted insurance provider has been marked by milestones that reflect our commitment to excellence.

5. Unique Value Proposition

What sets Associates Insurance Agency apart from competitors is our dedication to building lasting relationships with clients based on trust and integrity. We go the extra mile to deliver value through personalized insurance solutions that meet the specific needs of each client, ensuring their peace of mind and financial security.

6. Trustworthiness

Our reputation as a trustworthy insurance partner is built on a foundation of transparency, ethics, and reliability. We prioritize the best interests of our clients in every decision we make, ensuring that they receive the highest level of service and support. Our commitment to upholding ethical standards has earned us the trust of our clients and the community.

7. Management Team

Meet the key members of our management team who bring exceptional skills and experience to the table. With a diverse background in the insurance industry, our team is dedicated to driving the success of Associates Insurance Agency and serving our clients with professionalism and expertise.

8. Unique Services

Our unique services set us apart in the insurance industry, offering innovative solutions that cater to the evolving needs of our clients. From customized insurance packages to risk management strategies, we are committed to delivering exceptional services that exceed expectations.

9. Foundations of Our Business Success

At the core of our business success is our exceptional customer service, which goes above and beyond to meet the needs of our clients. We prioritize client satisfaction and strive to exceed expectations in every interaction, building long-lasting relationships based on trust and reliability.

10. Innovation Strategy and Future Plans

As we look to the future, our innovation strategy focuses on leveraging technology and industry insights to enhance our services and meet the evolving needs of clients. We have ambitious plans for growth and expansion, with a vision to continue delivering exceptional insurance products and services to clients across Florida.

11. Conclusion

In conclusion, Associates Insurance Agency stands out as a trusted insurance provider that prioritizes integrity, transparency, and exceptional service. With a commitment to building lasting relationships with clients and delivering customized insurance solutions, we are the top choice for individuals and businesses seeking comprehensive coverage and peace of mind.

Products / Services

Products and Services Offered by Associates Insurance Agency

Insurance Products:

Associates Insurance Agency offers a wide range of insurance products including auto insurance, home insurance, life insurance, health insurance, and business insurance. Their experienced agents work closely with clients to understand their needs and provide customized insurance solutions.

Financial Services:

In addition to insurance products, Associates Insurance Agency also offers financial services such as retirement planning, investment guidance, and wealth management. Their financial advisors help clients achieve their financial goals and secure their future.

Risk Management Consulting:

Associates Insurance Agency provides risk management consulting services to help businesses identify and mitigate potential risks. Their team of experts analyzes business operations and develops strategies to minimize risks and protect the business.

Claims Assistance:

In the event of a claim, Associates Insurance Agency offers claims assistance to help clients navigate the claims process smoothly. Their dedicated claims team provides support and guidance to ensure a quick and fair resolution.

Platform Enhanced Sections and Articles

Article by Siachen Editors to aid the customer in decision making

Evaluation Criteria for Choosing a Vendor in the Technology Sector

Quality of Products

When evaluating a vendor in the technology sector, one of the key considerations should be the quality of the products they offer. Customers should look for vendors that provide high-quality, reliable products that meet their needs and expectations.

Customer Support Services

Another important factor to consider is the level of customer support services provided by the vendor. Customers should choose vendors that offer excellent customer support, including technical assistance, troubleshooting, and product training.

Cost and Pricing

Cost is always a significant consideration when choosing a vendor. Customers should compare the pricing of different vendors and consider the overall value they offer in relation to the cost of their products and services.

Reputation and Reliability

The reputation and reliability of a vendor are crucial factors to consider. Customers should research the vendor's track record, read reviews from other customers, and ensure that the vendor has a good reputation for delivering on their promises.

Innovation and Technology Advancements

Customers should also consider the vendor's commitment to innovation and staying ahead of technological advancements. Vendors that invest in research and development and continuously improve their products are more likely to provide cutting-edge solutions.

Contract Terms and Agreements

Before finalizing a vendor, it is essential to review and understand the contract terms and agreements. Customers should ensure that the terms are favorable, transparent, and protect their interests in case of any disputes or issues.

Conclusion

In conclusion, when evaluating a vendor in the technology sector, customers should carefully consider various factors such as product quality, customer support services, cost, reputation, innovation, and contract terms. By thoroughly evaluating these criteria, customers can make an informed decision and choose a vendor that best meets their needs and requirements.

Article on latest trends and developments in this type of business

Latest Trends and Developments in the Insurance Industry

Introduction

The insurance industry is constantly evolving to adapt to changing consumer needs, emerging technologies, and regulatory requirements. In recent years, there have been several trends and developments that have shaped the landscape of the insurance industry. From the rise of InsurTech companies to the increasing focus on personalized insurance products, the industry is experiencing a period of significant transformation.

Digital Transformation

One of the most prominent trends in the insurance industry is the digital transformation of business operations. Insurers are increasingly leveraging technology to streamline processes, improve customer experience, and enhance risk assessment. From online policy management to automated claims processing, digital tools are revolutionizing the way insurance companies operate.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are being used by insurance companies to analyze vast amounts of data and make more accurate underwriting decisions. By leveraging AI and ML algorithms, insurers can assess risk more effectively, detect fraud, and personalize insurance products for individual customers.

Blockchain Technology

Blockchain technology is also making waves in the insurance industry by providing a secure and transparent platform for transaction processing. Insurers are using blockchain to streamline claims management, reduce administrative costs, and enhance data security. The decentralized nature of blockchain ensures that data is tamper-proof and easily accessible to authorized parties.

Personalized Insurance Products

Another key trend in the insurance industry is the shift towards personalized insurance products. Consumers are increasingly demanding tailored coverage options that meet their specific needs and lifestyle. Insurers are responding by offering customizable policies, usage-based insurance, and on-demand coverage options.

Telematics and IoT

Telematics and Internet of Things (IoT) devices are being used by insurers to gather real-time data on customer behavior and driving habits. This data is used to create personalized insurance plans that reward safe driving practices and incentivize policyholders to adopt risk-mitigating behaviors. Telematics devices track factors such as speed, distance, and braking patterns to assess risk accurately.

Parametric Insurance

Parametric insurance is another emerging trend that offers policyholders coverage based on predefined triggers rather than traditional loss assessments. This type of insurance is particularly useful for natural disasters and other catastrophic events where traditional claims processing may be delayed or hindered. Parametric insurance provides a quick and efficient way to disburse funds to policyholders in need.

Regulatory Compliance and Risk Management

With the evolving regulatory landscape and increasing cybersecurity threats, insurance companies are focusing more on compliance and risk management. Insurers are investing in robust cybersecurity measures, data protection protocols, and regulatory compliance frameworks to safeguard customer information and ensure adherence to industry standards.

Cyber Insurance

As cyber threats become more prevalent, the demand for cyber insurance policies is on the rise. Insurers are offering specialized coverage options to protect businesses and individuals from financial losses due to data breaches, ransomware attacks, and other cyber incidents. Cyber insurance policies provide coverage for data recovery, legal fees, and reputation management in the event of a cyber attack.

Compliance Automation

To ensure regulatory compliance, insurance companies are increasingly adopting automated tools and software solutions. Compliance automation streamlines the process of monitoring and reporting regulatory requirements, reducing the risk of non-compliance and potential penalties. By leveraging technology, insurers can efficiently manage compliance tasks and stay ahead of regulatory changes.

Conclusion

In conclusion, the insurance industry is undergoing a period of rapid innovation and transformation driven by digital technologies, changing consumer preferences, and regulatory pressures. Insurers that embrace these trends and adapt to the evolving landscape will be well-positioned to meet the diverse needs of customers and thrive in an increasingly competitive market. By leveraging data analytics, artificial intelligence, and personalized insurance products, insurance companies can enhance customer experience, improve risk assessment, and drive operational efficiency. As the industry continues to evolve, staying agile and proactive will be key to success in the dynamic world of insurance.

Last five profiles from the category:

-

Xact+ Accountants – Premier chartered accountancy firm specializing in tax, compliance, and financial services for UK businesses, with a focus on ecommerce – Suffolk, United Kingdom.

siachen.com/xactaccountantscouk

82a James Carter Road, Mildenhall, Suffolk, IP28 7DE, United Kingdom. land_line : +07763500273 -

The Pro Accountants – Empowering midsize to enterprise businesses worldwide with proven strategies and results, setting us apart from others – Florida, US.

siachen.com/proaccountants

7901 4th St N, St Petersburg, Florida 33702, United States. land_line : +14077684135 -

RTO Advisory Perth – Comprehensive RTO Consulting Services for Seamless Registration and Compliance – East Perth, Western Australia, Australia.

siachen.com/rtoadvisoryperth

Unit 7, 200 Adelaide Terrace, Perth WA 6004, Australia. land_line : 0861170919 -

Baelio – Secure and Swift Money Transfer App Enhancing Cross-Border Transactions Between Canada and Nigeria – Bedford, NS, Canada

siachen.com/baelio

1579 Bedford Highway Suite R202 Royal Bank Building, Bedford, NS, Canada. land_line : +9028885678 -

CRMBC – Self-Insured Group for Safety-Driven Restaurants in California, USACity – Fresno,Address – 7060 N. Marks Avenue, #116.

siachen.com/crmbc

7060 N. Marks Avenue, #116, Fresno, CA 93711, USA. land_line : +5595584800