Basic Details

| Dun & Bradstreet | |

| siachen.com/crifdunbradstreet | |

| Private Limited | |

| 2016 | |

| EG | |

| Option | |

| Cairo |

Communication

| CRIF Egypt Information Technology ARADO, 2 El Hegaz St., Roxy, Heliopolis, Building, Cairo Governorate 11736, Egypt | |

| +20221262929 | |

About Business

Business Summary

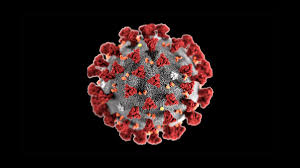

Dun & Bradstreet specialises in evaluating creditworthiness, providing in-depth insights into financial stability.

Business Description

Credit rating providers are invaluable partners in helping businesses mitigate risk. By meticulously evaluating a company's financial health, payment history, and creditworthiness, they offer a comprehensive view of potential risks. These insights empower businesses to make informed decisions when entering partnerships, extending credit, or pursuing investments. Through credit rating analysis, Dun & Bradstreet Egypt helps companies anticipate financial pitfalls and minimize exposure to uncertainties.

It's a proactive approach that shields assets, secures transactions, and ensures stable financial operations. Trust in Egypt’s best credit rating providers is the key to navigating a complex financial landscape with confidence, enhancing risk management, and safeguarding the future of your business.

Dun & Bradstreet specialises in evaluating creditworthiness, providing in-depth insights into financial stability. Whether you're an entrepreneur seeking loans, an avid investor assessing opportunities, or a lender managing risk, D&B’s Credit Rating offers clarity and guidance. It adheres to rigorous industry standards, ensuring the accuracy and reliability of our ratings. Our expert analysis empowers well-informed decisions, helping you secure loans, attract investors, and establish trust in the Egyptian financial landscape.

Choose CRIF Dun & Bradstreet, one of top Egypt’s credit rating providers for a stable and prosperous financial future. Please visit the website for more details.

Detailed Business Description

CRIF Dun & Bradstreet: Leading Credit Rating Provider in Egypt

1. Introduction

Credit rating providers play a crucial role in helping businesses manage risks effectively. By analyzing a company's financial health, payment history, and creditworthiness, they offer valuable insights that enable informed decision-making. CRIF Dun & Bradstreet, based in Egypt, is a trusted name in the industry, providing comprehensive credit rating services to businesses of all sizes.

2. About Business Sector

The business sector in which CRIF Dun & Bradstreet operates is essential for businesses looking to assess the creditworthiness of their partners, suppliers, and customers. By offering detailed insights into financial stability and risk assessment, the company helps businesses navigate the complex financial landscape with confidence.

With the latest trends in the sector focusing on enhanced data analytics, automation, and digital transformation, CRIF Dun & Bradstreet is well-equipped to meet the evolving needs of its clients. The future prospects of the sector are promising, with a growing demand for reliable credit rating services to support sound financial decision-making.

3. Primary List of Products and Services

CRIF Dun & Bradstreet offers a range of products and services tailored to meet the diverse needs of businesses. Some of the key offerings include:

- Credit Rating Analysis

- Financial Stability Insights

- Risk Assessment Reports

- Industry Benchmarking

- Customized Solutions

4. Company History & Founding

CRIF Dun & Bradstreet has a rich history of providing reliable credit rating services to businesses in Egypt. Founded with a vision to empower businesses with accurate financial information, the company has grown steadily over the years, achieving major milestones and earning a reputation for excellence in the industry.

5. Unique Value Proposition

What sets CRIF Dun & Bradstreet apart from its competitors is its commitment to accuracy, reliability, and excellence in credit rating analysis. By leveraging advanced analytics and industry expertise, the company delivers unparalleled value to its clients, helping them make informed decisions and mitigate financial risks effectively.

6. Trustworthiness

At CRIF Dun & Bradstreet, trust is at the core of everything we do. Our commitment to transparency, ethics, and reliability has earned us a reputation as a trustworthy partner for businesses seeking credible credit rating services. We adhere to the highest standards of integrity, ensuring that our clients receive accurate and unbiased insights to support their decision-making process.

7. Management Team

Our management team at CRIF Dun & Bradstreet comprises seasoned professionals with extensive experience in the financial services industry. Their exceptional skills, strategic vision, and commitment to excellence drive our success and enable us to deliver exceptional results for our clients.

8. Unique Services We Offer

One of the unique services offered by CRIF Dun & Bradstreet is personalized credit rating analysis tailored to the specific needs of each client. By providing customized solutions, we ensure that businesses receive accurate and actionable insights to support their financial decision-making process.

9. Foundations of Our Business Success

Our success at CRIF Dun & Bradstreet is built on a foundation of exceptional customer service. We go above and beyond to meet and exceed customer expectations, providing timely and accurate information to help businesses make informed decisions and mitigate financial risks effectively.

10. Our Innovation Strategy and Future Plans

As we look to the future, CRIF Dun & Bradstreet remains committed to innovation and excellence in credit rating services. Our strategic vision involves leveraging advanced technologies, data analytics, and industry expertise to deliver cutting-edge solutions that empower businesses to navigate the financial landscape with confidence and achieve their goals.

11. Conclusion

CRIF Dun & Bradstreet is the leading credit rating provider in Egypt, offering unparalleled value to businesses seeking reliable financial insights. With a commitment to trust, transparency, and excellence, we empower our clients to make informed decisions, mitigate risks, and secure a stable financial future. Choose CRIF Dun & Bradstreet for all your credit rating needs and experience the difference that expertise and integrity can make in your business success.

Products / Services

Products and Services Offered by CRIF Dun & Bradstreet

Credit Risk Management Solutions

CRIF Dun & Bradstreet provides comprehensive credit risk management solutions to help businesses assess the creditworthiness of their customers, manage credit risks, and make informed decisions. Their services include credit scoring, credit monitoring, credit reports, and credit risk assessment tools.

Business Information Services

The company offers business information services that enable organizations to access accurate and up-to-date information on companies, industries, and markets. These services help businesses identify new opportunities, mitigate risks, and make strategic decisions.

Compliance Solutions

CRIF Dun & Bradstreet provides compliance solutions to help businesses comply with regulatory requirements, anti-money laundering laws, and Know Your Customer (KYC) regulations. Their services include compliance checks, due diligence reports, and risk assessment tools.

Data Analytics and Insights

The company offers data analytics and insights services to help businesses analyze data, gain valuable insights, and make data-driven decisions. Their services include data enrichment, data cleansing, data modeling, and predictive analytics.

Platform Enhanced Sections and Articles

Article by Siachen Editors to aid the customer in decision making

Lead Marketing Solutions for Businesses

When evaluating a vendor for lead marketing solutions for your business, there are several key points to consider in order to make an informed decision. These points can help you assess the vendor's offerings and determine if they align with your business goals and objectives.

Data Quality and Accuracy

One of the most important factors to consider when choosing a vendor for lead marketing solutions is the quality and accuracy of the data they provide. Make sure to inquire about their data collection methods, sources, and update frequency to ensure that you are working with reliable information.

Targeting Capabilities

Evaluate the vendor's targeting capabilities to see if they can provide you with targeted lead lists that align with your ideal customer profile. Look for vendors that offer advanced segmentation options and the ability to tailor your marketing campaigns to specific audience segments.

Analytics and Reporting

Consider the vendor's analytics and reporting capabilities to ensure that you can track the performance of your marketing campaigns and make data-driven decisions. Look for vendors that offer comprehensive analytics tools and customizable reporting options.

Customer Support

Evaluate the vendor's customer support services to see if they can provide you with the assistance you need to maximize the value of their lead marketing solutions. Look for vendors that offer responsive support and resources to help you succeed.

D&B Finance Analytics

When considering a vendor for D&B Finance Analytics, it is important to assess their offerings and capabilities to ensure that they can meet your financial management needs. Here are some key points to consider when evaluating a vendor for D&B Finance Analytics:

Data-driven Decision-making

Look for vendors that can provide you with deep insights into financial trends, risk assessment, and growth opportunities to help you make informed choices. Ensure that the vendor's analytics solutions are comprehensive and tailored to your specific financial management needs.

Financial Strategies Optimization

Evaluate the vendor's tools and resources to see if they can help you optimize your financial strategies and streamline your operations. Look for vendors that offer customizable solutions for small businesses and large corporations alike.

Transformational Opportunities

Consider the vendor's ability to provide you with transformational opportunities for your financial management. Look for vendors that can help you secure your financial future and achieve your long-term goals through data-driven decision-making.

Get Started Today

Don't miss out on the opportunity to transform your financial management with D&B Finance Analytics. Contact us today to learn more about how we can help you optimize your financial strategies and secure your financial future.

Article on latest trends and developments in this type of business

Latest Trends and Developments in the Credit Rating Industry

Importance of Credit Rating Providers

Credit rating providers play a crucial role in helping businesses assess and mitigate risks related to financial transactions. By analyzing a company's financial health, payment history, and creditworthiness, these providers offer valuable insights that enable businesses to make informed decisions when it comes to extending credit, entering partnerships, or making investments. In Egypt, Dun & Bradstreet is a leading credit rating provider that specializes in evaluating creditworthiness and providing in-depth insights into financial stability.

Trends in Credit Rating Analysis

In recent years, the credit rating industry has seen several key trends and developments that are shaping the way businesses assess risk and make financial decisions. One of the notable trends is the shift towards more sophisticated credit rating models that take into account a wider range of factors beyond just financial data. This includes incorporating non-traditional data sources such as social media activity, online reviews, and customer feedback to provide a more holistic view of a company's creditworthiness.

Another trend in the industry is the increasing focus on transparency and accountability. Credit rating providers are under pressure to ensure that their rating methodologies are transparent and consistent, allowing businesses to understand how their ratings are determined. This trend is driving greater collaboration between credit rating agencies and businesses, as companies seek to improve their credit profiles and secure better financing options.

Emerging Technologies in Credit Rating

Advancements in technology are also playing a significant role in shaping the credit rating industry. Machine learning and artificial intelligence algorithms are being used to analyze vast amounts of data quickly and accurately, allowing credit rating providers to offer more precise and timely assessments of credit risk. These technologies are also enabling the development of new credit scoring models that can better predict the likelihood of default and identify potential red flags in a company's financial profile.

Blockchain technology is another emerging trend in the credit rating industry, offering secure and transparent ways to verify and validate credit information. By leveraging blockchain, credit rating providers can create immutable records of credit ratings, reducing the risk of fraud and manipulation in the credit assessment process. This technology is expected to revolutionize the way credit information is shared and accessed, making the credit rating process more efficient and reliable.

Regulatory Developments in Credit Rating

Regulatory changes are also impacting the credit rating industry, with regulators around the world introducing new rules and guidelines to enhance transparency and accountability. In Egypt, the Financial Regulatory Authority (FRA) plays a key role in overseeing credit rating agencies and ensuring compliance with industry standards. These regulatory developments are aimed at improving the quality and reliability of credit ratings, ultimately benefiting businesses and investors who rely on these ratings to make informed financial decisions.

Conclusion

In conclusion, the credit rating industry is experiencing significant changes driven by technological advancements, regulatory developments, and evolving market trends. Businesses in Egypt and around the world are increasingly relying on credit rating providers like Dun & Bradstreet to assess credit risk, make informed decisions, and navigate the complex financial landscape with confidence. By staying abreast of the latest trends and developments in the industry, businesses can better manage risk, secure financing, and achieve long-term financial stability.

Last five profiles from the category:

-

Move On Removals – Expert moving services offering personalized, reliable, and stress-free relocation solutions for homes and businesses – Melbourne, Victoria, Australia.

siachen.com/move-on-removals

620 Lorimer Street, Port Melbourne VIC 3207, Australia. land_line : +0396363299 -

OXO Packaging Australia – Leading provider of eco-friendly custom packaging solutions for various industries, prioritizing sustainability and quality – Victoria, Australia.

siachen.com/oxopackaging

3 Compton St TRUGANINA VIC 3029 Australia. land_line : 0272288555 -

Dave Truck Driving School – Excellence in Truck Driver Training with a Commitment to Safety and Quality Education – West Sacramento, California, USA.

siachen.com/davetruckdrivingschool

2945 Ramco street land_line : +19163801218 -

Montenegro Electrical Contractors and Associates LLC – Trusted electrical services with over two decades of experience in residential and commercial projects, prioritizing safety, quality, and customer satisfaction – Arlington, Nevada, United States.

siachen.com/montenegroelectricalcontr

500 N Rainbow Blvd Suite 300, Las Vegas, NV 89107, United States land_line : +12147641172 -

1836 Construction Company – Redefining custom home building and remodeling with transparency, trust, and unparalleled craftsmanship – Texas, USA.

siachen.com/1836construction

750 South Main St. Suite 150 #28, Keller, TX 76248, United States. land_line : +8173004319